WHAT'S THE BIG DEAL?

Jeremy Corbyn is the frontrunner in the Labour leadership battle, and much of

the lead he has gained is thanks to a plan for generating growth that is being dubbed ‘Corbynomics’.

So what is ‘Corbynomics’, how radical is it in reality, and does it stack up

as a practical plan for creating economic growth?

“Labour shouldn’t be swallowing the story that austerity

is anything other than a new facade for the same Tory plans.”

~ Jeremy Corbyn,

Labour Party leader

POLICY 1: NATIONAL INVESTMENT BANK

Proposal to develop a “National Investment Bank” using

the Bank of England to give the UK control over expenditures

and improve transparency.

Jeremy Corbyn plans to increase revenues by raising

£5 billion using a 50% tax rate.

WEALTH OF NATIONS

“The third and last duty of the sovereign or commonwealth is that of erecting and maintaining those public institutions and those public works, which, though they may be in the highest degree advantageous to a great society, are, however, of such a nature that the profit could never repay the expense to any individual or small number of individuals, and which it therefore cannot be expected that any individual or small number of individuals should erect or maintain.”

Adam Smith

Adam Smith was a British moral philosopher, pioneer of political economy, and key Scottish Enlightenment figure.

FACT #1

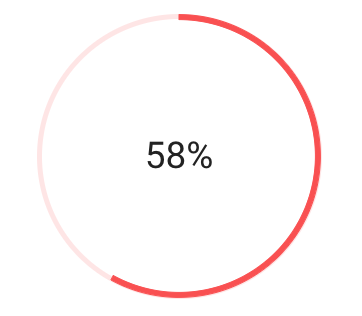

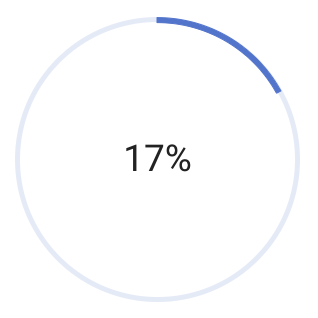

THE BRITISH PUBLIC SUPPORT

NATIONALISATION OF PUBLIC SERVICES

In favour of privatisation of public services:

Oppose privatisation of public services:

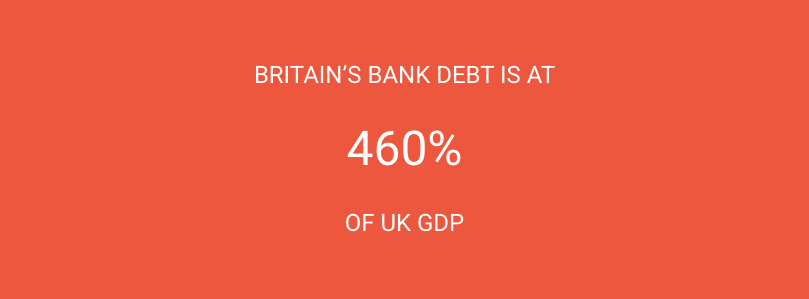

FACT #2

BRITISH BANK DEBT IS GETTING OUT OF CONTROL

NATIONAL INVESTMENT BANK: PROS AND CONS

PROs

Would give the Bank of England greater autonomy to operate by conceding control of private shareholders and interests.

Could avoid the disastrous policies used by Syriza and other socialist movements by mapping a workable economic plan.

Would end or greatly reduce monetisation of debt and trading of lucrative City contracts for PFI debt.

CONs

Stopping QE may cause funding shortages at times where infrastructure projects are near completion.

If not properly regulated and made transparent, could socialise net losses which are funded by taxpayers.

May create shortages in funding based on faulty or unrealistic target revenues proposed by Corbyn’s financial analysis team.

POLICY 2: PEOPLE’S QUANTITATIVE EASING

Proposal to Create a “People’s Quantitative Easing” programme that would revitalise the UK economy by spending printed money on national projects.

People’s Quantitative Easing does not require an increase in fiscal debt using the NIB QE policy, as bonds acquired by the Bank of England would go back into national capital.

POWER TO THE PEOPLE

“People’s QE is fundamentally different. [It] does have the Bank of England print new money, […] but it gives that money to people like housing authorities, to local councils, to a green investment bank to build houses, to schools to build hospitals. The very things Chris Leslie says would not be possible if this programme was put into place.”

Richard Murphy

Richard Murphy is an economist who advises the TUC on economics and taxation, and a long standing active member of the Tax Justice Network.

KEY FACTS

20%

—

TRADITIONAL QUANTITATIVE EASING (QE) CURRENTLY COMPRISES 20% OF UK GDP

14%

—

MANUFACTURING RATES ACCOUNT FOR ONLY 14% OF UK GDP, DEMONSTRATING THE UK’S LACK OF COMPETITIVENESS IN GLOBAL MARKETS

375 Billion

—

IN 2009, £375 BILLION WAS SPENT ON RISKY DERIVATIVES AND SECURITIES, AND NOT ON THE PEOPLE

PEOPLE’S QE: PROS AND CONS

PROs

Does not require an increase in fiscal debt using the NIB QE policy, as bonds acquired by the Bank of England would go back into national capital.

Differs from Ed Balls 2009 QE policy, where £375 billion was spent on risky derivatives and securities, and not on the people.

Would transfer economic gains to household spenders instead of private shareholders of the BoE and other institutions.

CONs

Must avoid negative interest rates which will create flat yields commonly associated with current QE trends in Britain, the EU and United States.

Could simply boost fiscal debt (raising the debt ceiling) instead of using QE money from the National Investment Bank.

BoE chairman Mark Carney stopped QE 3 years ago and is now tightening interest rates. This may be difficult to reinstate.